Introduction

One of the major goals of beginning a business is to become financially independent. Business owners must evaluate the impact of their financial management decisions on earnings, cash flow, and the company's financial position. Every component of a business has an influence on the company's financial success, and the owner must monitor and oversee these operations.

During the initial phase, most businesses lose money and have negative cash flow. During this period, financial management is critical. Even if there is more money going out than coming in during the early months of a firm, managers must ensure that they have adequate cash on hand to pay staff and suppliers. This implies the owner must forecast the negative cash flows in order to determine how much money will be required to finance the firm until it becomes profitable.

As a company develops and matures, it will require more cash to fund its expansion. It is critical to plan and prepare for these financial requirements. Financial managers must decide whether to support expansion internally or borrow money from outside lenders.

Financial management includes locating the most cost-effective source of money, regulating the company's cost of capital, and preventing the balance sheet from being overly loaded with debt, which might harm the company's credit rating.

What factors influence overall business growth and sustainability?

Financial management in day-to-day activities

A company's regular operations include providing a product or service, making a sale to a client, collecting the money, and repeating the process. Financial management is effectively transferring funds through this cycle. This entails keeping track of raw material and finished goods inventory turnover ratios, selling to clients and collecting receivables on schedule, and then beginning again with new raw materials.

Meanwhile, the company needs to pay its expenses, suppliers, and workers. All of this done with cash and ensuring that these monies flow smoothly requires intelligent financial management. Even while economies have a long history of rising, they do undergo severe falls from time to time. Businesses must plan ahead of time to have adequate liquidity to weather these economic downturns, or they risk having to close their doors due to a lack of funds.

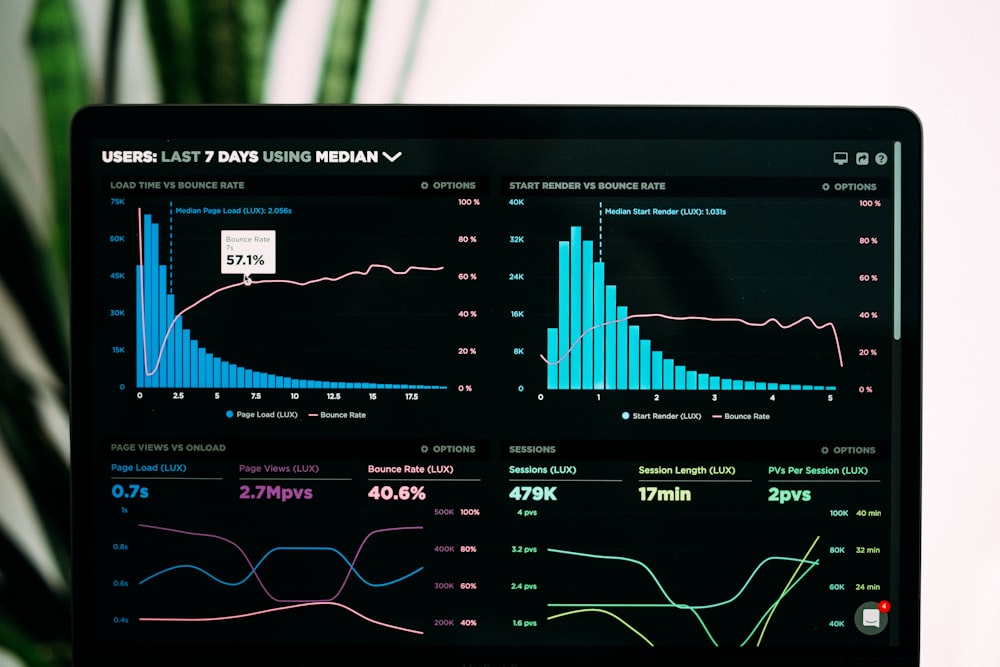

Keeping track of business activities

Every company is accountable for reporting on its activities. Shareholders expect to get frequent updates on the performance and safety of their assets. Reports are required by state and municipal governments in order to collect sales tax. Other sorts of reports, such as those containing key performance indicators that monitor the actions of various divisions of a company, are required by business managers. A complete financial management system may also generate the many sorts of reports that each of these organizations needs.

Observance of legal requirements

The government is always on the lookout for methods to collect taxes. Financial management must make arrangements to pay taxes on time. Every small business owner or manager has to know how to manage money. Every action a business owner takes has a financial impact on the firm, and he must make these decisions in the context of the entire business.

What are the benefits of financial management in a business?

- Aids in the financial planning of businesses.

- Assists organizations with funding planning and acquisition

- Aids organizations in making the best use of and distributing cash obtained or gained.

- Assists businesses in making important financial decisions.

- Aids in increasing the profitability of businesses.

- Increases the firm's or organization's overall worth

- Ensures economic security

- Employees encouraged to save money, which aids in personal financial planning.